The vast majority of the savings comes from becoming debt-free and no longer having the combined $60,000 in debt service to the mortgage and student loans.

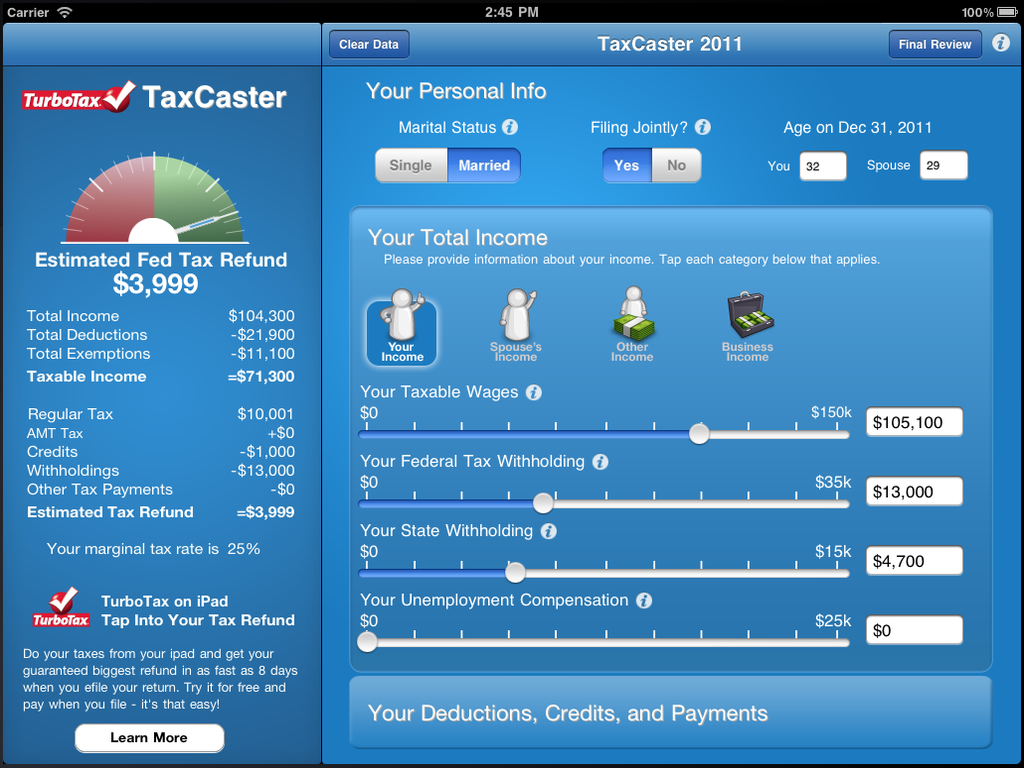

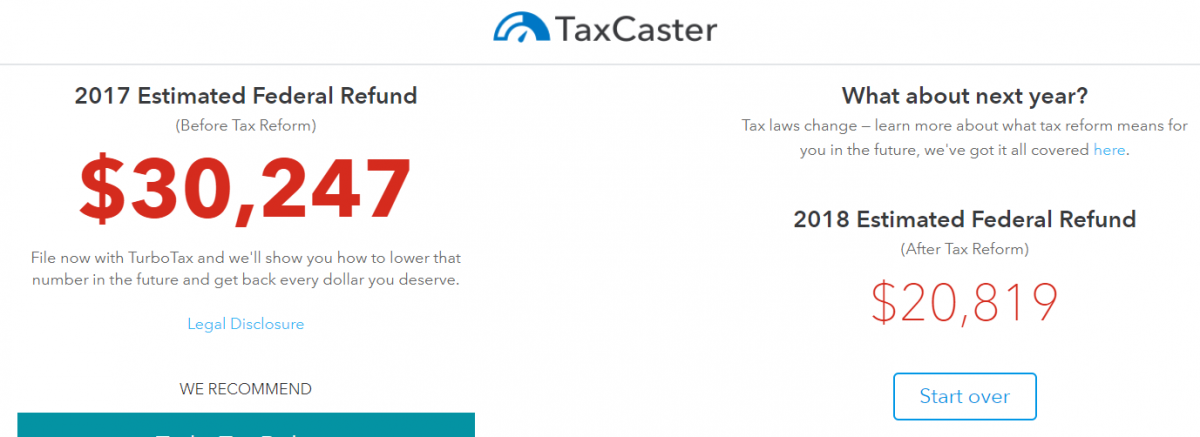

With the household of four dropping to two, a number of line items on the annual budget will shrink. Before long, he will have paid off his $36,000 a year mortgage, he will no longer be paying off his own student loans or contributing to his childrens’ 529 Plans, and his grown children will be off on their own. Will he continue to require $160,000 a year in retirement? Benson from the Tale of 4 Physicians who was on track to retire with $4 million in about 20 to 25 years with $160,000 in annual spending. Let’s crunch some numbers and examine what you might expect to pay when you make the transition from wage earner to early retiree. Much, much lower tax rates are on the horizon for the aspiring early retiree. That tax burden doesn’t have to last indefinitely, though.

I’ve paid closer to $2 Million in the last 15 years. If you’ve managed to accumulate a sizable nest egg over 20 years or less, you’ve no doubt contributed at least $1 million to the coffers of the taxman. Adding up federal & state income tax and property taxes, many physicians will have annual tax bills exceeding $100,000.

0 kommentar(er)

0 kommentar(er)